-

by sayum

16 February 2026 7:15 AM

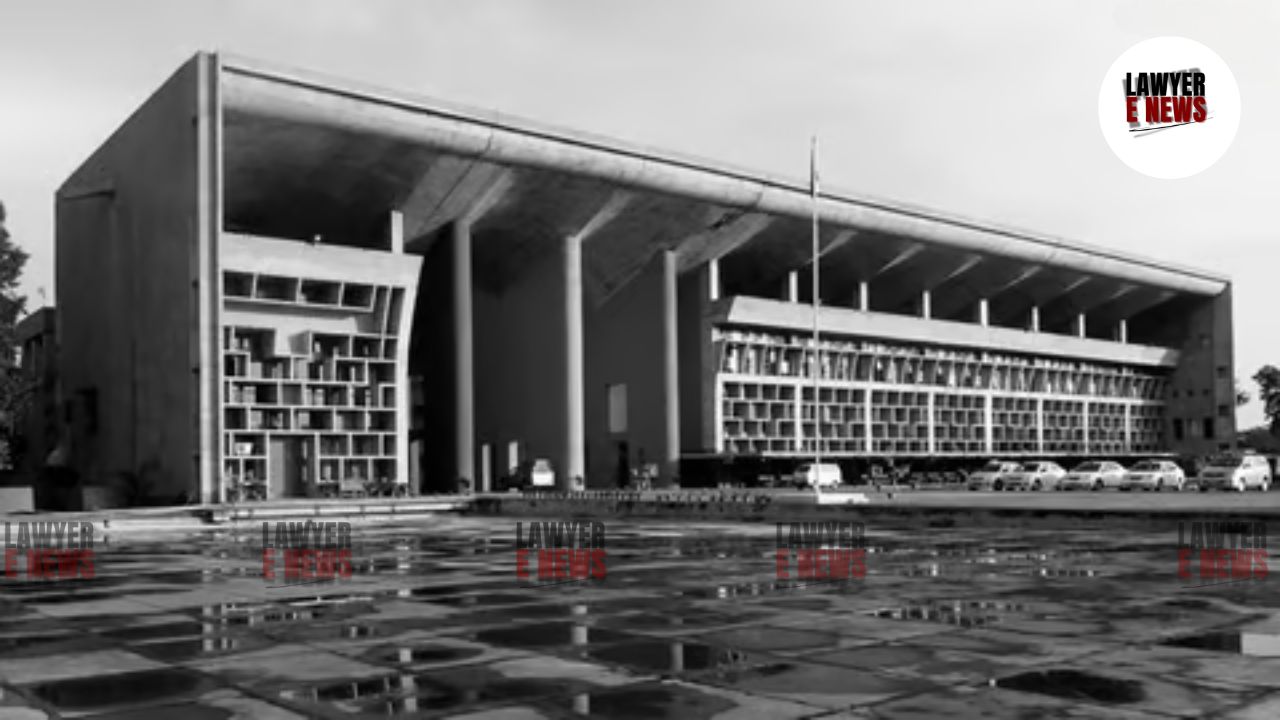

Punjab & Haryana High Court directs refund of Rs. 1.86 lakh recovered from retired PSPCL employee without prior notice." In a significant ruling, the Punjab & Haryana High Court has set aside recovery orders issued by Punjab State Power Corporation Ltd. (PSPCL) against a retired employee, Khem Singh. The court emphasized the importance of adhering to principles of natural justice and referenced the Supreme Court’s judgment in State of Punjab vs. Rafiq Masih, which prohibits such recoveries under specific circumstances.

Khem Singh, who served as a Meter Inspector with PSPCL and retired on June 30, 2017, had amounts of Rs. 40,551 and Rs. 1,45,708 deducted from his gratuity payments in 2017 and 2023 respectively. These deductions were attributed to alleged excess payments made due to erroneously granted increments during his service from 2013 to 2022. Singh contested these recoveries, claiming they were made without issuing a show cause notice or providing an opportunity for a hearing, violating natural justice principles.

The court criticized the PSPCL for unilaterally making deductions from Singh’s gratuity without prior notice or a hearing. "Recoveries made without adhering to the principles of natural justice, such as issuing a show cause notice or personal hearing, are fundamentally flawed and cannot stand," the court observed.

Justice Namit Kumar underscored the applicability of the Supreme Court's ruling in Rafiq Masih, which outlines scenarios where recoveries from employees are impermissible. These include recoveries from retired employees, employees due to retire within a year, and cases involving excess payments spanning over five years.

The judgment reiterated that recoveries from retired employees, especially those from Group C or Class III posts, are impermissible unless obtained through fraud or misrepresentation by the employee. "The facts and circumstances of the present case suggest no fraud or misrepresentation by the petitioner, warranting the recovery to be declared unlawful," the court stated.

Justice Kumar emphasized, "The stand of the respondents-Corporation is not sustainable as even if an excess amount based on wrong fixation of pay was paid to the petitioner, the same cannot be recovered from him after his retirement."

The High Court’s decision to quash the recovery orders against Khem Singh highlights the judiciary's commitment to protecting employees' rights, especially post-retirement. By directing the refund of the recovered amounts with interest, the judgment reinforces the importance of natural justice and adherence to legal precedents set by higher courts. This ruling is expected to set a strong precedent for similar cases, ensuring that retired employees are not unduly burdened by retrospective financial recoveries.

Date of Decision: 12 July 2024